October 14, 2025

The Cost of Being Your Own Bank — and What We Do To Fix It

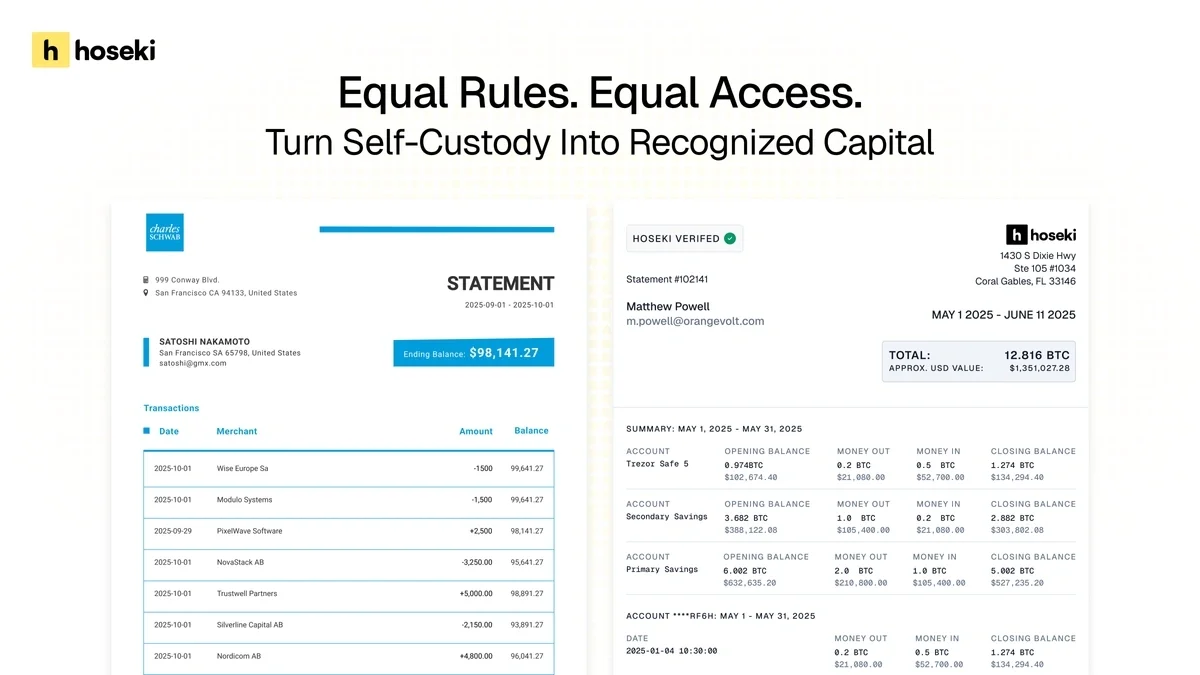

Today’s financial system is built on insiders trusting each other. If your assets are at Schwab, Morgan Stanley, or Wells Fargo, they count as financial capital. Those institutions recognize each other’s records. Your brokerage statement or property deed can unlock access to credit, investment opportunities, and financial products.

But if you hold your Bitcoin yourself, you are unfortunately not in that club.

Locked Out of the System

Bitcoin held directly by individuals doesn’t come with a custodian’s statement, so it isn’t treated like other assets in the traditional financial system.

The result is exclusion. To participate in capital markets today, Bitcoin holders must give up custody and place their wealth in the hands of an institution.

Freedom vs. Dependence

Custody isn’t just a tradeoff of convenience — it’s a tradeoff of freedom.

When your assets are held by a custodian, you’re vulnerable to censorship, confiscation, and institutional failure that can lock your funds in bankruptcy court for years.

Self-custody removes these vulnerabilities. Your Bitcoin is yours, secured by cryptography, free from the possibility of counterparty risk. That’s one of Bitcoin’s most important features — and it shouldn’t be lost the moment you want to include it as your wealth.

Bridging Two Worlds

Here’s the challenge: capital markets require proof. Credit, underwriting, and financial products all depend on verifiable ownership. In the current system, that proof comes from custodians.

With Bitcoin, ownership can be proven cryptographically. But we can’t expect every institution to suddenly understand cryptography or trust it on faith — so we need ways to bridge that gap, translating cryptographic proof into forms they already recognize.

Currently, this gap forces individuals to surrender custody — sacrificing freedom for access.

Building a Fairer Financial Future

The future of finance shouldn’t demand that tradeoff.

Equal verification means self-custodied Bitcoin can be recognized on the same footing as custodial assets. It means wealth held directly — immune from counterparty risks — can still participate in the speed, efficiency, and opportunity of modern financial markets.

That’s the goal: combining the freedom of self-custody with the legitimacy of professional capital markets.

Bitcoin shows us it’s possible to hold wealth independently. Now we need verification rails that let that wealth be counted — not just by custodians, but by the system as a whole.

Equal verification is how Bitcoin becomes true wealth. And it’s how finance itself evolves into something more open, neutral, and free.